In order to ease you into the buying process here in Mexico, below is the most important information to know before purchasing a home in Alamos, Sonora, Mexico.

Restricted and Non-Restricted Areas

Foreigners may obtain direct ownership of property in the interior of Mexico. However, under Mexican law, foreigners cannot acquire direct ownership of residential property within the area of 100km from the border or 50km from the coastline.These areas are known as the Restricted Zone.

It is possible, however, to acquire beneficial rights to use, improve, and enjoy property in the restricted zone through a Bank Trust or “Fideicomiso” authorized by the Mexican Government under the ministry of Foreign Affairs.

The Fideicomiso (Bank Trust) is established for a 50 year renewable term and grants the beneficiary the right to use, rent, modify, or sell property. An advantage of the Bank Trust is the avoidance of probate upon the death of the beneficiary when a substitute is named.

Property Acquired for Personal or Commercial Use

Commercial

Property acquired for commercial use by foreigners may be owned without the need for a Bank Trust, provided that the property is held in a Mexican corporation. Depending on the type of business, it is often possible for a foreigner to own 100% of the Mexican corporation.

Personal

Should you decide to own property in your own name, a deed called an Escritura must be issued by a Mexican notary public. In this case, we recommend having a Mexican Will prepared ro avoid legal fees to probate at the time of death.

In all cases (commercial or personal use), each and every document needed for the transaction must be validated by a notary public or Notario Publico. Otherwise, the transaction is not legal.

Lawyers and Notary Publics

A lawyer is not necessary when acquiring real estate in Mexico, as the notary public is legally authorized to carry out the transaction.

Among other things, the Notary is responsible for the title search as title companies are not commonly used in Mexico.

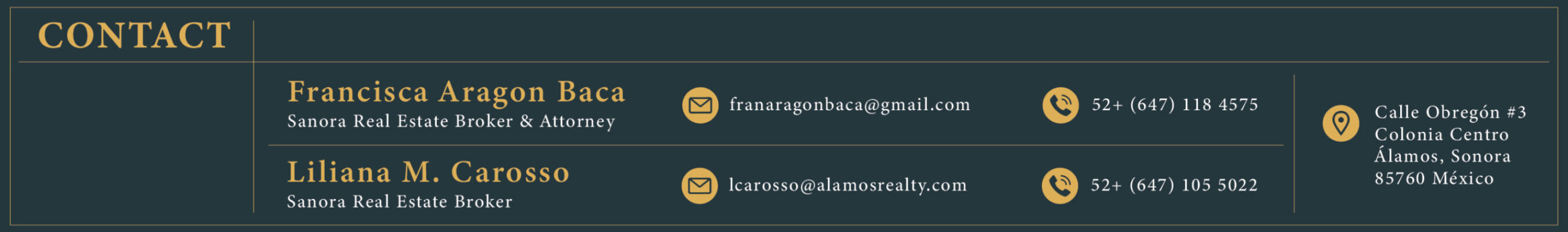

As with any investment, we recommend seeking counsel in order to investigate all options, and working with a reliable Real Estate Office.

What Is Needed and What Steps to Take

In the state of Sonora, your Real Estate agent can assist you in every step of the process, beginning with the initial review of the seller’s deed or Escritura.

In order to obtain the permit to own property as a foreigner, Passport or Entry Visas, along with the official property description to be purchased, must be copied and notarized to be submitted to the Secretaría de Relaciones Exteriores (or Foreign Ministry).

Then, several documents must be gathered to do a title search. These include

- The Certificado de Libertad de Gravamen, which serves as proof of no liens

- The Carta de Valor Catastral, which states the assessed value of the property as recorded by the Municipality

- The Carta de Catastro, stating the lot dimensions, location within or without the restricted zone, and serves as proof that the property taxes are paid and up to date.

An official Bank Appraisal (or Avaluo) is the next most important document, as every major fee and tax incurred in the title transfer for both the buyer and the seller will be based on this appraisal.

Closing

Real Estate transactions in Mexico are “closed” by a Notario Publico (notary public), who acts as a neutral intermediary. The Notary is further responsible for formalization of the final Real Estate transaction, and the calculation and collection of the Capital Gains Tax, which is a Federal tax and usually a seller’s expense.

After signing the closing papers, and once the seller has received full payment, full rights of ownership and possession pass to the buyer.

Tax and Other Payments

At this point there are a couple of remaining steps. These include the tax payment to the Tesoreria (Municipal Treasury) for the transfer of title or Traslado de Domicilio.

As of 1994, the transfer tax rate is 2.5% of the bank appraised value. Property taxes, known as the Predial, are very low in Alamos, and are based on the assessed value or Valor Catastral. The Predial is paid annually and is due in the first quarter of each year.

Final Steps

The final step is recording the deed and title by paying the recording fees and submitting the Escritura to the Public Registry Office (Registro Público de la Propiedad).

The transaction is now complete, and now you can use your copy of the Escritura to change the name on all the utility services. Welcome to your new home in Alamos!

If Unable to Physically Attend the Closing

In the event that either the buyer or the seller is unable to physically attend the closing or to be present during the acquisition process, a Power of Attorney or Poder can be signed, limited only to the specific transaction.

If the Power of Attorney must be signed in the foreigner’s country of residence (outside of Mexico), in order for it to be valid in Mexico, it must be signed before a notary, and then must be accompanied by an Apostille, which can be secured from the Secretary of State Office - Department of Licensing.

Once these steps have been completed, the process proceeds as described above.